The Importance of Risk Disclosure in Financial Management: A Neutrosophic Multi-Criteria Decision-Making Approach

Keywords:

Financial Management; Risk Management; Risk Disclosure; Multi-Criteria Decision Making; Neutrosophic Set.Abstract

Risk disclosure plays a vital role in promoting transparency, stability, and efficiency in

stock markets by providing investors with the necessary information to make well-informed

decisions. However, its effectiveness varies across companies, industries, and regulatory

frameworks, influencing market volatility, investor confidence, and overall financial stability.

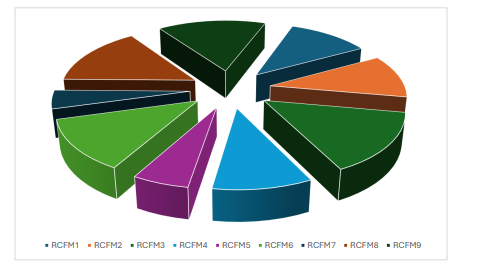

This study applies a Multi-Criteria Decision-Making (MCDM) methodology to analyze different

factors affecting risk disclosure. Specifically, we use the Entropy method to determine the weight

of each criterion and the MAIRCA method to rank alternatives based on their importance. To

address uncertainty in the evaluation process, we incorporate the Type-2 Neutrosophic Set as a

mathematical approach to deal with imprecise or incomplete information. To ensure the

reliability and robustness of our findings, we conducted sensitivity and comparative analyses,

testing the stability of the rankings and the effectiveness of our proposed approach. This study

highlights the critical role of risk disclosure in financial management and provides a quantitative

framework that can help companies and investors assess risks more accurately and make better

financial decisions.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.