Neutrosophic Vision of the Expected Opportunity Loss Criterion (NEOL) Decision Making Under Risk

Keywords:

Operations research; decision-making theory; decision making under risk; neutrosophic science; neutrosophic decision-making theory; neutrosophic missed opportunity criterionAbstract

One of the major challenges facing decision-makers at the present time is obtaining complete

information about the issue under study, due to the unstable conditions of the work

environment that are beyond the control of decision-makers, which requires them to reach an

optimal decision in light of these circumstances and fluctuations and to benefit from the data

that is collected. Collected by specialists to determine the appropriate probability distribution

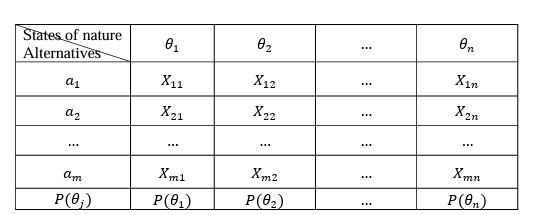

corresponding to random cases of nature, here we are faced with the issue of making a

decision in the event of risk because the probability distribution is a distribution linked to the

data controlled by the conditions of the work environment, which entails a great risk.

Decision makers bear the responsibility of choosing the optimal decision that reduces This

risk is achieved and the greatest possible profit and the least possible loss are achieved. The

issue of decision-making becomes more complex as the number of events increases, and we

are in dire need of an ideal study of the issue that takes into account all the circumstances of

the work environment. The concept of missed opportunity is very useful in analyzing the

decision making under risk, after making the decision and the occurrence of events, the

decision makers may regret and wish they had chosen actions different from those they chose

at the beginning. To reduce the regret of the decision makers and minimize the expected lost

opportunity, researchers in the field of classical operations research presented the criterion

of the expected lost opportunity through which the decision can be determined. The ideal

with the least percentage of regret. In this research, we present a neutrosophic vision of the

expected opportunity loss criterion by taking the data of the issue under study. neutrosophic

values are ranges whose lowest limit expresses profit in the worst conditions, and only the

highest represents profit in the best conditions.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.