Stock Price Predictions with LSTM-ARIMA Hybrid Model under Neutrosophic Treesoft sets with MCDM interaction

Keywords:

MCDM, TOPSIS, AHP, Treesoft sets, deep learning, LSTM, ARIMA, Stocks, equitiesAbstract

The stock market is regarded as volatile, complex, tumultuous, and dynamic.

Forecasting stock performance has proven to be a challenging endeavour due to its increasing

need for investment and growth prospects. At the forefront of machine learning, deep learning

models facilitate the straightforward and efficient exploration and identification of optimal

stocks, the hybrid forecasting models (LSTM and ARIMA) are used in the prediction of stock

increase. This paper incorporated the MCDM technique to determine the optimal stocks for

investment. The Analytic Hierarchy Process (AHP) is used to assign weights to various

financial factors. These weights are then used by the Technique for Order Preference by

Similarity to Ideal solution (TOPSIS) technique, which is a component Multi Criteria Decision

Making method (MCDM), to compute and rank the optimal stocks for investment. Stock

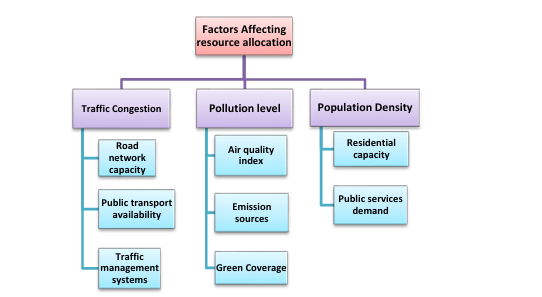

analysis involves considering numerous criteria and sub-criteria, which might lead to an

unsuitable answer. To address this uncertainty, we utilize Neutrosophic Treesoft sets, which

primarily handle numerous criteria, sub-criteria, and an increased number of sub-sub-criteria.

Given a larger number of criteria, we will be capable of providing a precise solution to the

problem. Furthermore, the definitions of fuzzy treesoft sets and neutrosophic treesoft sets have

been presented for the first time. A plotly graph is generated to compare the real and projected

stock prices for all the equities. All these are implemented using the program language python,

which seems to be simple and easily understandable when compared to the other programming

languages like Julia, MATLAB and so on. This hybrid methodology facilitates the forecast of

stock prices, the ranking of stocks based on several financial and non-financial factors using

AHP and TOPSIS, and the visualization of the outcomes.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.