Analysis of the discretion in the sanctioning power of tax offenses in relation to the constitutional principles of pro- portionality and equality, using surveys and Neutrosophy for qualitative data analysis

Main Article Content

Abstract

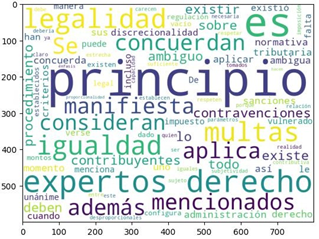

This scientific article focuses on the study of discretion in the sanctioning power of tax offenses and its relationship with the constitutional principles of proportionality and equality. To achieve this, a methodology is employed that combines surveys and interviews to collect qualitative data from taxpayers and the tax administration. Once the data is collected, an analysis is conducted using the neutrosophic approach, which seeks to evaluate the elements of truth, falsehood, and indeter- minacy present in the opinions and experiences of the participants. The main objective of the article is to examine how discre- tion in the imposition of tax sanctions violates constitutional rights, using the Constitution of the Republic of Ecuador, the Tax Code, the Organic Administrative Code, and the Organic Integral Penal Code as objects of study. The aim is to identify the causes of non-compliance with tax obligations, enhance knowledge about procedures, and analyze irregularities and issues stemming from such non-compliance. Through the use of surveys and interviews, a comprehensive and diverse understanding of participants' perspectives is sought. The neutrosophic approach provides an analytical tool to assess the validity and rel ia- bility of the collected data, allowing for a rigorous and objective analysis of discretion and the involved constitutional principles.In conclusion, this study aims to shed light on the interaction between tax discretion and constitutional rights, and provide recommendations for improving the sanctioning system in the tax field.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.