Model of Tax Culture Impact on the Financial Sustainability of Small and Medium Enterprises in Ecuador Based on Neutrosophic HyperSoft Sets

Keywords:

Tax Culture, Financial Sustainability, Small and Medium Enterprises (SMEs), Single-Valued Neutrosophic Set, Hypersoft Set, Neutrosophic Hypersoft Set, Decision-MakingAbstract

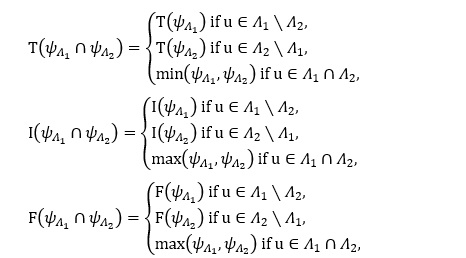

The tax culture of a country consists of several factors to take into account. Tax evasion is a widespread problem in the world today. Ecuadorian Small and Medium Enterprises (SMEs) as a whole have a great impact on the country's economy and have a weight to consider. This is why it is important to measure the tax behavior of Ecuadorian SMEs. This paper aims to propose a neutrosophic model to measure the tax culture of SMEs in Ecuador. To do this, we base on a model designed from the Neutrosophic theory and HyperSoft Sets. Hypersoft Sets extend Soft Sets from a single parameter to multiple parameters. On the other hand, when it is hybridized with the Single-Valued Neutrosophic Sets theory allows the inclusion of indeterminacy in this model. The article illustrates the model with an example.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.