Development Level Evaluation of Tax Governance Digitalization Using Quadripartitioned Single-Valued Neutrosophic Sets

Keywords:

Tax Governance; Digitalization; Development Level Evaluation; Quadripartitioned Single-Valued Neutrosophic Sets.Abstract

A key component of improving the accountability, efficiency, and openness of public

financial institutions is the digital transformation of tax governance. Assessing the degree of

development of digital tax governance has become crucial for institutions and policymakers due

to the increasing needs for safe data management, sophisticated audit systems, and real-time

compliance on a worldwide scale. Using a neutrosophic set evaluation methodology, this study

suggests a thorough framework for determining the level of digitalization maturity in tax

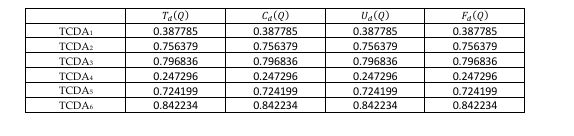

governance. Six digital governance options are evaluated using eight fundamental criteria, which

range from regulatory preparedness to automation, cybersecurity, and AI integration. The study

finds important development trends, digitalization gaps, and performance standards among

governance models by combining expert opinion with methodical comparative methodologies.

This study uses the neutrosophic set to solve uncertainty problems. We use Quadripartitioned

Single-Valued Neutrosophic Sets framework to rank the alternatives.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.