Evaluating the Role of Investor Sentiment Dynamics in Tadawul Stock Market Using Hybrid Wang-Mendel Fuzzy Logic: A Bridge to Neutrosophic Uncertainty

Keywords:

Wavelet; Wang-Mendel; Neutrosophic ; Stock MarketAbstract

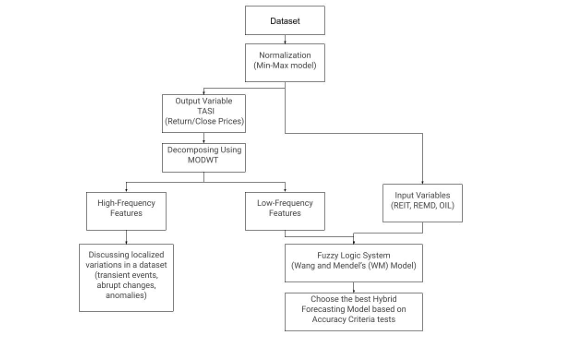

This study enhances the precision of predicting daily Saudi stock market closing prices

and returns by integrating the Maximum Overlapping Discrete Wavelet Transform (MODWT)

spectral model with the Wang-Mendel (WM) method, the latter known for generating interpretable

fuzzy rules and its financial applications like the Wang transform for risk pricing. WM forms the

foundation for Neutrosophic Logic, which expands it by adding indeterminacy (I) and falsity (F) to

truth (T) for advanced uncertainty modeling. Utilizing five wavelet basis functions and daily

Tadawul closing prices (August 2017 - September 2022), inputs for Model (1) predicting returns

(SMR) were selected as Real Estate Investment Trusts return(REIT), Real Estate Management &

Development returns (REMD), and Brent oil returns (ROIL), while Model (2) predicting closing prices

(NSM) used Real Estate Management & Development closing prices (NREMD) and Brent oil closing

prices (NOIL), following variable selection via multiple regression, multicollinearity (tolerance, VIF),

fixed/random effects, unit root, and Granger causality tests, with min-max normalization applied.

Results show MODWT-d4 with ARIMA(1,0,0) (non-zero mean) for Model (1) and MODWT-d4 with

ARIMA(5,1,0) for Model (2) outperformed other wavelets on the 80% training data based on lower

error; furthermore, the MODWT-C6-WM hybrid model surpassed traditional models in forecasting

the remaining 20% for returns (Model 1), while the MODWT-La8-WM hybrid excelled for price

forecasting (Model 2).

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.