A Neutrosophic SuperHyper Number Framework for Accurate Statistical Evaluation of Financial Performance in High-Tech Enterprises

Keywords:

Neutrosophic Numbers; SuperHyper Uncertainty; Financial Performance; High-Tech Enterprises; Neutrosophic Statistics; Indeterminacy; SuperHyperFunctions; NSHNPI; Neutrosophic Logic; Uncertain Decision ModelsAbstract

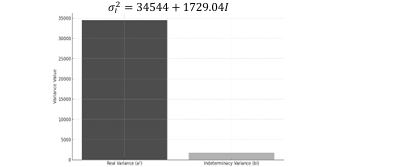

This paper introduces a new mathematical model that evaluates the financial

performance of high-tech enterprises using neutrosophic numbers and superhyper

uncertainty theory. Traditional financial analysis often fails to address incomplete,

indeterminate, or conflicting information. To solve this problem, we develop a

Neutrosophic SuperHyper Number Framework (NSHNF) that combines elements from

neutrosophic

number theory, superhyper structures, and neutrosophic

probability/statistics. Each financial metric is modeled as a neutrosophic number in the

form x=a+bI, where I capture indeterminacy. These values are then structured using

powersets Pn to allow for multiple levels of uncertainty. We introduce several new

formulas, such as the Neutrosophic Mean, Variance, and a new index called NSHNPI

(Neutrosophic SuperHyper Number Performance Index). Realistic examples are provided

with full calculations to show the model's usefulness and accuracy. This work represents

a new direction in financial evaluation by combining strong mathematical logic, deep

uncertainty handling, and practical applications in business analytics.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.