A Neutrosophic Topological and Algebraic Model for Evaluating Venture Capital Performance in Small and Medium-Sized Technology Enterprises

Keywords:

Neutrosophic Logic, Venture Capital, SMEs, Uncertainty, Topology, Bi-LA Semigroup, Investment Modeling.Abstract

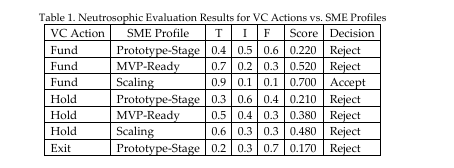

This paper presents a new mathematical model for analyzing venture capital

(VC) decisions in small and medium-sized technology enterprises (SMEs). The model is

based on two novel neutrosophic structures. First, we introduce the Neutrosophic Risk

Topological Space (NRTS), which represents the uncertainty, trust, and risk in VC

decision-making using a special type of topological structure. This space captures the

changing nature of technology startups by allowing each possible decision state to be

measured in terms of truth, indeterminacy, and falsity. Second, we develop the

Neutrosophic Bi-LA Venture Capital Algebra (NBVC), an algebraic system that models

interactions between investors and startup projects. The NBVC framework uses two

binary operations to express both agreement and conflict in VC negotiations. Together,

these two frameworks allow a complete and detailed evaluation of investment scenarios

under real-world uncertainty. The paper includes mathematical definitions, logical

proofs, and full calculation examples. Our results show that neutrosophic tools can

provide deeper insights into VC dynamics and offer more accurate models than

traditional fuzzy or classical systems.

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.