Enhancing Cryptocurrency Prediction: A Fusion of Machine Learning and Neutrosophic Programming

Keywords:

Hybrid modeling, Machine learning, ARIMA, TBATS, Optimization methods, Neural networks, Time series forecasting, Neutrosophic programmingAbstract

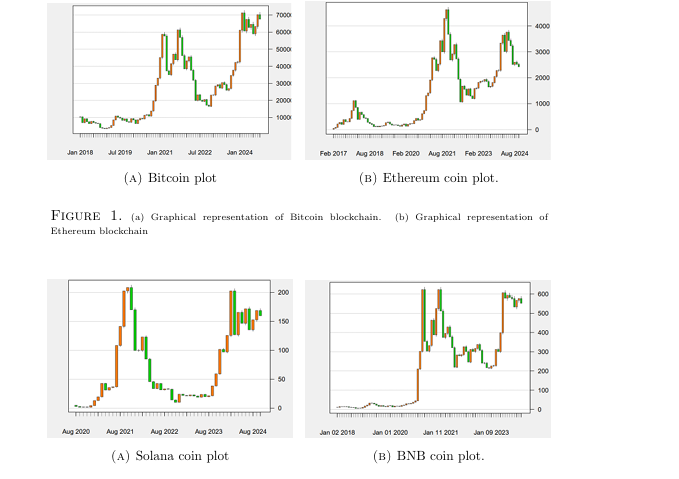

Fluctuations in cryptocurrency markets present a significant problem to the accuracy of forecasting

trends and prices in this field. This paper proposes a new method of improving cryptocurrency forecasting

by applying machine learning algorithms to a hybrid model. The framework integrates, a neural network

model, with auto regressive integrated moving average (ARIMA) and trigonometric, Box-Cox, ARMA, Trend,

Seasonal (TBATS) to capture the intricate relationship and dynamics in the data. Because most aspects

affecting the cryptocurrency’s price are uncertain, we propose that fuzzy parameters be used to reflect this

uncertainty in the market. Furthermore, we apply neutrosophic programming to optimize predictions where the

indeterminacy of the data is considered. The hybrid model thus incorporates short-term market volatility and

long-term market trends, making the model rigid and accurate. Here, we compare this approach’s performance

with other forecasting models using actual cryptocurrency data. The results indicate that the hybrid model

developed achieves better predictive accuracy and is more flexible than the conventional models. To sum

up, this research offers significant knowledge of applying the newest machine learning methods to enhance

cryptocurrency prediction and improve its efficiency for investors, traders, and financial institutions

Downloads

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.