Country Risk Assessment for Foreign Investments Using Neutrosophic PESTEL- SWOT

Keywords:

Country Risk, Foreign Investment, PESTEL, SWOT, Neutrosophic, Uncertainty, Evaluation, Emerging MarketsAbstract

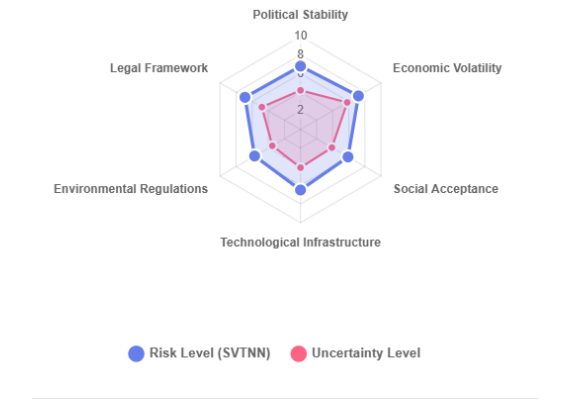

Purpose of the study: To measure country risks for foreign direct investments by assessing a neutrosophic PESTEL-SWOT. Design/methodology/approach: The PESTEL assessment includes political, economic, social, technological, environmental, and legal components while SWOT composes strengths, weaknesses, opportunities, and threats. In uncertain settings, a neutrosophic PESTEL-SWOT was generated. A survey of experts' data corresponding to qualitative and quantitative determinations was assessed through genuine mathematic techniques and an integrated PESTEL and neutrosophic SWOT to determine risk probability within a Latin America focus. Findings: The induced PESTEL-SWOT model measures country risks with a 70% efficiency rate to forecast certain outcomes for foreign direct investments per international experts. Most importantly, social elements weigh the greatest while legal factors are heavily persuasive. Research limitations/implications: Should investors reside and practice in different nations, internationally developed neutrosophic PESTEL-SWOT assessments could indicate similarly trustworthy findings. Practical implications: The neutrosophic PESTEL-SWOT is a practical tool for investors to assess risks because in an uncertain world, achieving more certain projections is vital. Originality/value: This technique is seldom used for risk assessments without assessing uncertainty; applying this project to other developing countries would enhance risk assessments for investment.

Downloads

Downloads

Published

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.