Selecting Optimal Monetary Policies for the Peruvian Housing Market Using the Neutrosophic OWA-TOPSIS Model

Keywords:

Monetary policy, housing market, neutrosophic OWA-TOPSIS, uncertainty, PeruAbstract

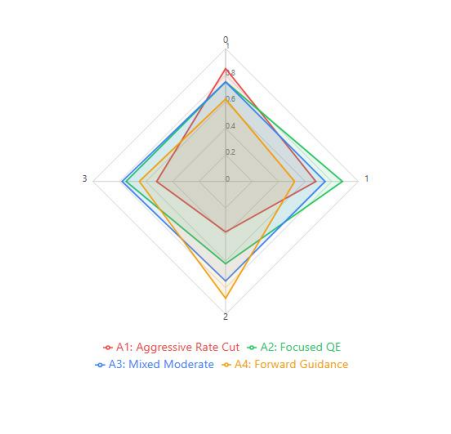

This research contributes to the literature where ideal monetary policy selection to increase housing demand in Peru is still lacking for a vulnerable sector that can easily become unstable in times of recession. This research is significant because policymakers should pay attention to the real estate sector as it has economic and social welfare implications due to the current housing deficit situation across the country and international investors and lenders. Although previous articles have assessed how monetary policy transmits through the housing sector, few pay attention to the adoption of uncertainty itself. Therefore, prevailing methods do not comprehensively assess how expected interest rates and public sentiment play a crucial role in decision-making options regarding the housing market. Thus, we fill this gap through the neutrosophic OWA-TOPSIS approach, which allows for uncertainty via neutrosophic numbers and assesses the alternatives of interest rate adjustment and open market operations against the decision-making criteria of housing affordability, housing investment, and financial security. The results show that a hybrid solution of low interest rates with an expansionary strategy best satisfies the housing demand versus financial risk mitigation assessment. This study contributes to the body of literature through a novel solution approach to assessing multifaceted socioeconomic concerns and provides the Central Reserve Bank of Peru with applied research results to formulate monetary policies related to fostering a sustainable housing market, which ultimately translates to reduced housing inequality.

Downloads

Downloads

Published

License

Copyright (c) 2025 Neutrosophic Sets and Systems

This work is licensed under a Creative Commons Attribution 4.0 International License.